About Andy Zhu

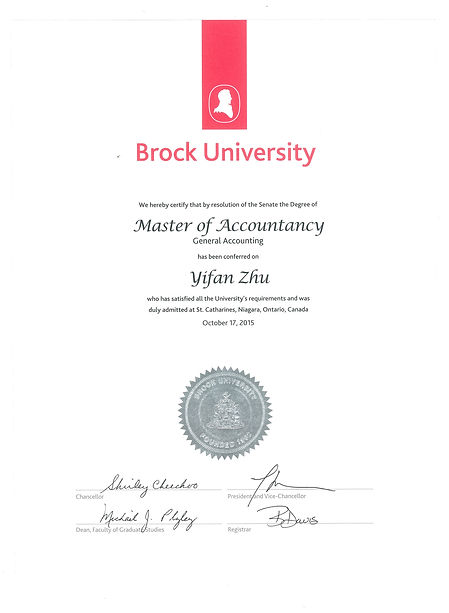

Andy Zhu, Chartered Professional Accountant of Canada, Ontario, Licensed Public Accountant in Ontario. He graduated from Goodman School of Business at Brock University in Canada and was successfully awarded Master of Accountancy (MAcc).

He has many years of professional working experience in Canadian CPA Firms, including KPMG LLP and Toronto medium-sized accounting firms. Andy Zhu's professional work experience includes but is not limited to:

- Performed the audit for the clients on several industries including High-tech, Agriculture, Utilities, Real Estate, Manufacturing, Wholesale, Pension Plan,Not-for-Profit and Condominium under the applicable accounting standards (IFRS, ASPE and ASNPO) for national and international entities; Annual revenue of these entities are up to CAD 1 billion dollar.

- Performed Canadian Tire Franchising Audited & Review Financial Statements, Resturant Franchising including McDonald's and Montana's Review Annual Financial Statements & Monthly Financial Statements and Corporate Tax Preparation;

- Engaged in the Pre-IPO audit engagements for national and international entity (such as Global Food and Ingredients Inc(PEAS.TSXV), Kalmarna Limited (Tonisity BVI) in Toronto Stock Exchange and worked efficiently in the audit team to ensure the engagementent can be delivered to client as expected timeline;

- Worked in the Group Audit for Pre-IPO international entity in Toronto Stock Exchange under different applicable Accounting Standard (IFRS, USGAAP and IAS);

- Managed multiple audit and non-audit engagements for various industries including Mmanufacturing, Real estate, Supply chain management, Music publishing, Investment Holding, Retail, Professional etc;

- Delivered multiple audit and non-audit engagements as per expected timeline including the first-year audit (transition from review and special industry – Music publishing).

- Prepared Compilation Engagements under CSRS 4200. Revenue is up to 20 million and associated company is more than 20;

- Prepared corporation income tax returns and the related supporting working papers; Client includes No Frills Franchise, Real Estate, Professionals, Restaurant, Printing Store, Retail Store, Consulting, Investment company, Artists and Producer etc;

- Be involved in several complicated tax topics such as Safe Income and Subsections 55(2) and 55(2.1), Corporation Reorganization under Section 84.1 and 84(2), Association Rules, preparation of T1134 forms under CRA new standard;

- Prepared individual income tax returns and answer the questions from individuals; Client includes Realtor, Self-employment and hundreds of individuals;

- Full cycle Accounting and Tax Preparation & Tax Planning for Small Business & Owners;

Andy Zhu's Professional Qualifications:

Chartered Professional Accountant

Licensed Public Accountant

Master's Degree in Accounting from Brock University

ProAdvisor Gold Accountant, officially certified by QuickBooks Online

Andy Zhu also attended the following professional training courses:

- Hundreds of hours of CPA continuing education courses for auditing accounting assurance business provided by KPMG LLP;

- The Tax Letter, Video Tax News and Tax Letter published by CanTax Tax Weekly

- CPA Continuing Education Course on Accounting, Auditing and Tax Law provided by CCPAA and CPA ontario;

- Quickbooks Level I at Seneca College;

- Fundamentals of Income Tax by H&R Block;

- C/A Annual Tax Seminar at CADESKY TAX;

- Corporate and Business Tax and Personal Income Tax Course offered by Softron tax company;